Does Your Risk Management Program Cover Global Risk?

If not you may have serious risk exposure hiding just under the surface.

Global risk is one of the most important risk considerations for companies today. Risk creates opportunity, and intelligence makes opportunities a reality.

As the Department of Justice recently confirmed that “companies are on the front line in responding to geopolitical risks.”

International events around the world move at a lightning pace, making it hard for companies to keep up with changes, and companies of all sizes are struggling to adapt.

As Chris Mason and Dr. Ian Oxnevad recently explained at Bloomberg:

"Effective risk management strategy must account for new regulatory pressures and a shifting geopolitical landscape. This centers on knowing where a company may be vulnerable to risk exposure wherever there is a breakdown in international relations."

Managing global risk requires access to the right intelligence.

Infortal Worldwide provides discreet, white glove intelligence collection and advisory services to protect your firm from risk and thrive in global markets.

Do You Have Access to Global Risk Intelligence?

Depending on your industry, you may experience the direct impact of war or geopolitical risk on your supply chain. We’ve seen major increases to shipping and insurance costs in certain regions already. Understanding where the next hot spot is can allow you to better prepare and save on supply chain costs in the near to long term. Global risk intelligence can make this possible.

Scenario: A growing telecom provider seeking to expand their operations in Central America contacted Infortal to vet potential local partners. We examined the region from a bribery and corruption standpoint to assess viable logistics solutions and new partners.

Solution: Based on our research, the client was able to avoid doing business with a potentially corrupt third party. Without our intelligence the telecom company would have taken on the risk of significant reputational damage.

Our Global Risk investigations can help your team avoid FCPA pitfalls, allowing you to benefit from the upside of doing business in high-risk areas.

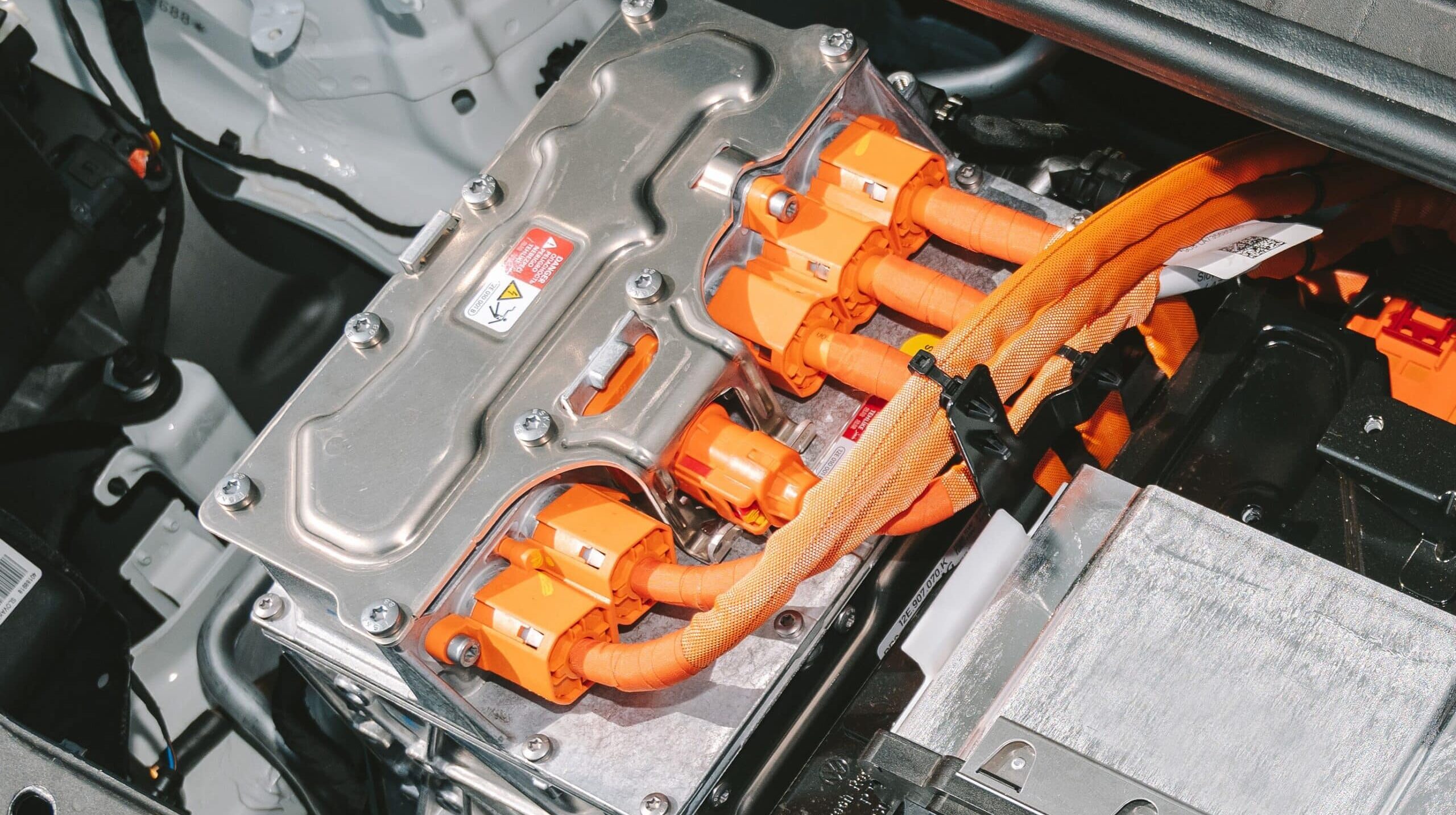

Scenario: A client in the E-Battery manufacturing space was seeking to expand operations in SE Asia. This required taking on a new partner and giving up equity in her company.

The owner found an investor based in the Eastern hemisphere with a business presence spanning the globe. Before moving forward, the company owner reached out to Infortal to gain a true understanding of the future partner’s business practices.

This required locally sourced intelligence and cultural understanding to shine a light on how the investor operated in past situations.

Solution: We were able to unravel the web of companies tied to the investor and establish a breakdown of his business practices, including a lengthy litigation history regarding contracts.

Based on the information we uncovered, the owner’s legal team was able to structure the deal in a way to better protect her stake in the company and avoid any future contract disputes.

Infortal’s Global Risk Intelligence will empower your legal team to improve your negotiation position and better protect your long term investment prospects.

Scenario: A leading financial institution seeking to invest in Europe asked for assistance unpacking the local business customs and norms surrounding partnerships and perceptions of reputational risk before deciding to make an investment.

This included examining the political implications of the company's previous role in a political campaign.

Solution: Based on our political risk investigation, we were able to clearly map out the potential reputational implications of doing business with the politically exposed company and executives allowing the financial institution to make an informed investment decision.

Infortal’s political risk intelligence removes the guesswork from managing risk at the intersection of business and politics in international jurisdictions.

Clients benefit from Infortal’s intelligence capabilities tailored to your needs and aligned to your international growth objectives.

According to business leaders, today’s geopolitical risks are the most severe they have been since WWII. The International Monetary Fund explained that geopolitical fragmentation and conflict are “serious financial stability threats.” Global risk comes in various forms and includes threats from corporate espionage, crime, and corruption to supply chain disruption from war and government appropriation. Risk intelligence is the key to maintaining resiliency in the face of geopolitical risk. Good risk intelligence provides your firm with the foresight to anticipate and respond to emerging threats, avoiding chaos and loss. In fact, the right risk intelligence can uncover new opportunities and unlock a larger market share. What you need and we can provide:

Global Risk Intelligence Services:

When conducting business overseas you need to make sure that you conduct deep due diligence investigations to mitigate third-party risks and geopolitical risks. In certain situations, only global due diligence investigations will allow you to understand current or emerging risk scenarios. Other times, geopolitical risks require timely risk intelligence to allow your company to gain advantage.

This can become complicated in new markets where local customs and norms differ widely, and requires expertise in how to conduct investigations in global markets.

Does your firm need expert advice on how to manage Global Risk?

Infortal Worldwide’s Global Risk Advisory team focuses on establishing a tailored approach to your company’s risk profile and management needs. With over 39 years of providing intelligence-guided and risk-based solutions, Infortal has deep experience in managing risk across borders in over 160 countries.

In the age of Artificial Intelligence (AI), deepfakes, geopolitical risks, and rapid social and technological change, your company’s strategy must account for global risk exposure. Your long-term resiliency depends on it. Contact Infortal today to discuss how we can help protect your firm from harm by taking a proactive approach to managing third-party risk and geopolitical tension.

Avoiding global risk and deploying intelligence to mitigate crisis begins with conducting an audit of your risk exposure to various risks across your supply chain. Our audits include analyzing the entirety of your company’s exposure to political risks, from securing capital and suppliers to assessing your customers.

Infortal’s audits leverage both our international reach and expertise from the worlds of investment banking, intelligence, academia, and law enforcement to help implement these solutions to meet your needs.

After completing an audit, we provide Actionable Recommendations™ your team can take to manage risks.

We can also provide training and/or assistance in implementing a new global risk management strategy.

We take a risk-based approach to breaking down each unique scenario into categories of risk that can be independently or collectively managed. This feeds directly into your overall risk management strategy and can include ongoing monitoring or consultation for the duration of your project.

Are you prepared to deal with cartels in Mexico or threats to your intellectual property in China

What happens if you intend to do business with a company in a country like China, only to find out after the fact that bribery is simply the standard cost of conducting business?

Did you know that your foreign investments as a company could lead you to commit an actual crime inadvertently?

It’s one thing to familiarize yourself with major international business sanctions such as sanctions against Russia’s energy imports…

What do you do when your business is struck by a public relations crisis that’s entirely NOT your fault?

Whether it’s severe flooding in Thailand that disrupts your technology supply chain network…

If your company was located in the Middle East in 2010 or 2011, you most likely had no idea the Arab Spring revolutions were coming.

It seems unlikely you could ever predict the next terrorist attack unless you have all the resources of the CIA at your disposal.

How do you know if doing business with a State Owned Enterprise (SOE) like China (with its global holding companies) is really safe?

Russia’s invasion of Ukraine is the perfect, tragic example of what can happen to businesses if you don’t see a war coming long before it actually arrives.